Creditors of a major collapsed building firm have just received the devastating news they are unlikely to recover a single cent of their lost funds.

Unsecured creditors of collapsed building firm Porter Davis are unlikely to recover a single cent of their lost funds.

Those are the sobering details released on Wednesday according to a credit report compiled by the liquidators from insolvency firm Grant Thornton.

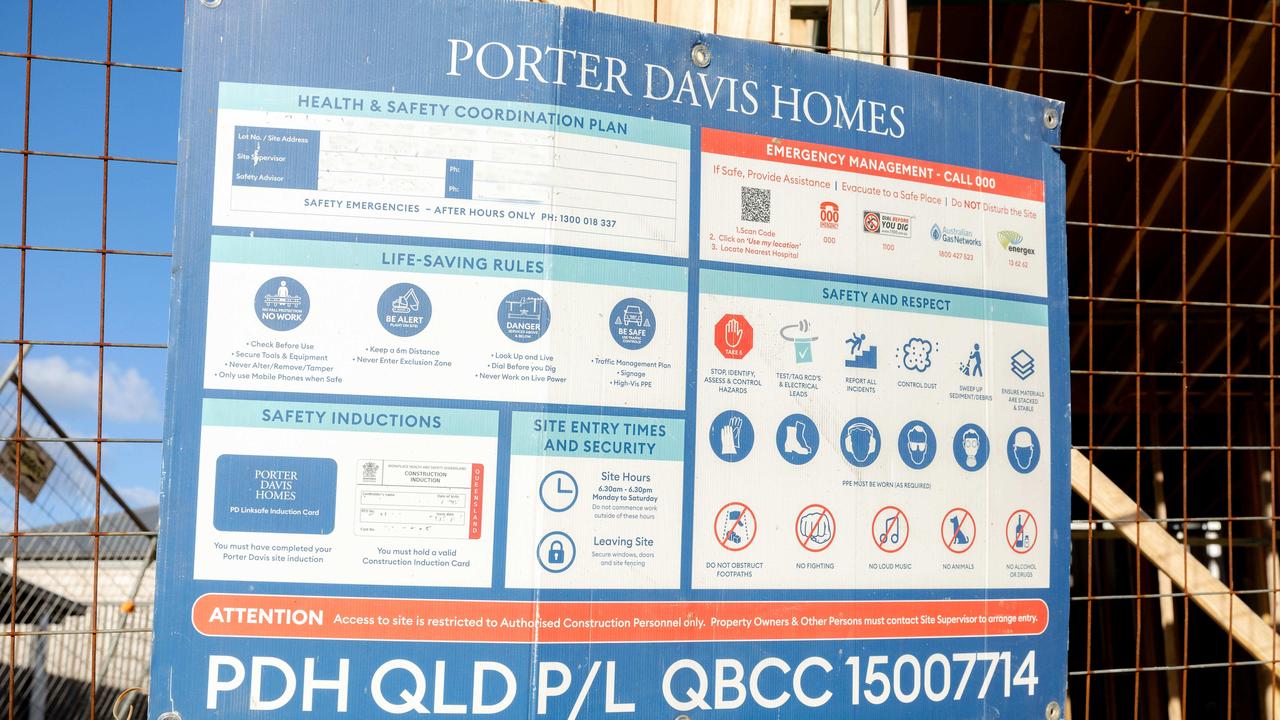

In March, Australia’s 13th largest home builder Porter Davis Homes went bust, placing 1700 projects and another 779 empty blocks of land in jeopardy across Victoria and Queensland.

At last count, the company owed a whopping $71 million to unsecured creditors.

The liquidators have warned that these funds are unlikely to ever be recovered.

Luckily most customers are set to be partially reimbursed by insurance companies or a government bailout.

Of those homeowners, 560 of them had paid a deposit but Porter Davis had never taken out building insurance, leaving them with no automatic payout from the insurer.

Yet in an unprecedented step, Victorian Premier Daniel Andrews agreed to refund them their lost money in a $15 million government bailout in April.

However, all the other unsecured creditors – mostly tradies – will have to wear the cost. It could put many out of business as they face financial ruin.

Porter Davis owes $147 million at last count. Picture: Richard Walker

In total, the failed building firm owes $146.5 million to creditors.

Of that, $57.5 million was owed to two secured creditors, the Commonwealth Bank and another company called Chesapeake, owed $32.9 million and $24.6 million respectively.

Porter Davis also owes about $18 million to its employees in unpaid wages, leave and superannuation.

Only the CBA is expected to get its money back “in full”.

Chesapeake and employees will receive a “partial dividend” as they are priority creditors.

Everyone else, estimated to be more 1000 unsecured creditors, has been warned that their status is “dividend unlikely”.

The liquidators also revealed that they still plan to pursue some customers over debts to increase the amount of cash they have to disperse to creditors.

Grant Thornton said around $16.77 million worth of building works had been carried out which had yet to be paid for.

“These debts primarily relate to invoices issued to customers at the completion of a stage in their build, i.e. the customer has received the benefit of works undertaken to completion of that particular stage and has been invoiced accordingly,” the report stated.

“Given we are still actively assisting some customers in achieving occupancy, some of the above accounts receivable will be recovered.”

They said customers could try to “offset” their debts if they had lost money as a result of the Porter Davis collapse.

“However, there will be instances where debts are due and payable and the liquidators will seek to recover those amounts for the benefit of creditors,” they warned.

News.com.au previously reported that several customers – who had incomplete homes and were thousands out of pocket – were worried they would be personally pursued by the liquidators to pay more, after receiving a stern email to that effect.

Customers of collapsed builder Porter Davis protested and received a government bailout as a result. Picture: Richard Walker

Porter Davis has more than 20 assets that “may be recoverable”.

They have conducted 13 sales of furniture which has netted them $142,000.

The report also found that Porter Davis had been insolvent since at least February 2023. There were “indicators of insolvency” prior to that.

Tradies may have suspected their money was unlikely to be recovered as there were several reports of disgruntled contractors trashing homes in the wake of the company’ collapse.

disgruntled tradies reportedly left one homeowner with $50,000 worth of damage to her house.

The new mum said the sink and bathroom taps were intentionally left running in her Melbourne build, flooding the property with 7cm of water.

All of the doors and walls were also scratched with a knife.

She believed the damage was caused by subcontractors working on the home.

The very next day, a Clyde North property being built by Porter Davis caught fire.

Police said they were investigating a suspicious fire at the under-construction Porter Davis home, after firefighters were called to the property.

Photos from the scene showed the two-storey home still partially ablaze with most of the roof and upper floor torched.

One Porter Davis customer news.com.au spoke to at the time, Ben Kucenko, said upon hearing the news of the company’s collapse he raced to secure his building site and removed signage to try to spare his property from acts of revenge.

The Victorian government has announced plans to clamp down on building laws to better protect consumers from being left with uninsured homes, because of what happened in the case of Porter Davis Homes.

The next creditor meeting will be held later this month, on June 28.

Leave a Reply